Child's Marriage

Saving for Child’s Marriage

Marriage expenses are difficult to estimate but are undoubtedly rising each year. Even in tier-2 cities, the per plate cost can range between ₹2,000 to ₹5,000, while in tier-1 cities, it’s much higher — and it will only continue to increase with time. By starting to invest in Mutual Funds today, you spread the expense over the years and avoid a sudden financial burden when your child’s big day arrives. Goal-based saving through SIPs in Mutual Funds ensures you can celebrate this milestone joyfully, without compromising on your other financial priorities.

The earlier you start investing in Mutual Funds for your child’s marriage, the lighter your financial burden will be in the future. Starting small today with SIPs in Mutual Funds can grow into a sizeable fund over time, thanks to the power of compounding.

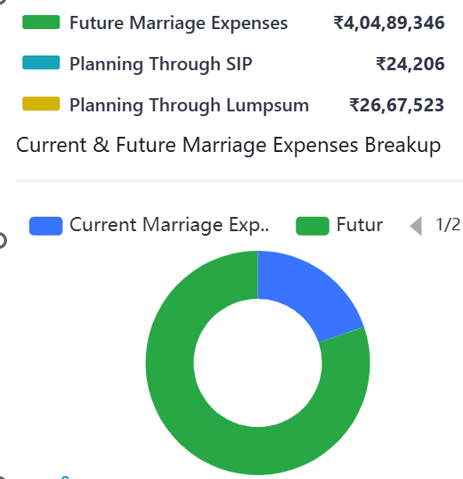

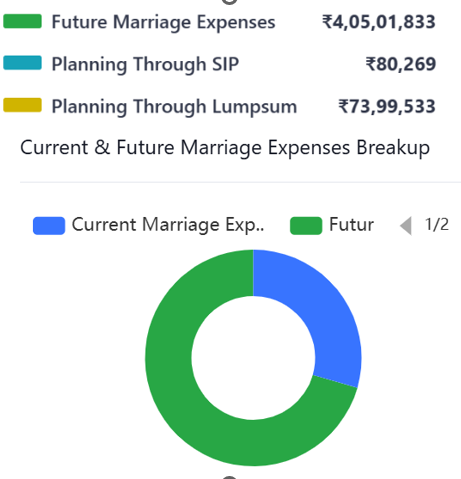

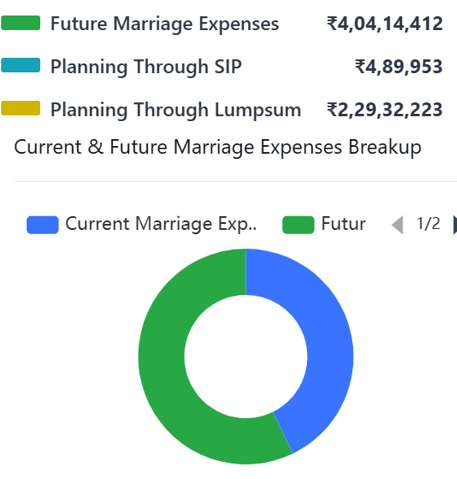

Say Age at the time of Marriage: 25, Suppose Current Marriage Expense: 1,00,00,000, Projected Rate of Inflation 6%, Projected Rate of Return 12%

Investment started when Age was 1

Investment started when Age was 10

Investment started when Age was 20

Point to note

👉The later you start your Mutual Fund investment, the higher your SIP or lump sum requirement for the same future goal.

👉 Starting to invest in Mutual Funds early makes the goal achievable with smaller, manageable investments, as compounding works over a longer period.

This is a classic demonstration of the power of compounding and why financial planning should begin as early as possible.

Benefits of Saving for Child’s Marriage

- Avoids Last-Minute Stress – A planned corpus ensures you’re financially prepared for wedding expenses without scrambling for funds.

- Beats Rising Costs – Marriage expenses inflate every year. Early savings protect you from the steep rise in venue, catering, and other costs.

- No Compromise on Celebrations – With dedicated funds, you can host the kind of wedding you and your child desire without cutting corners.

- Protects Other Goals – By earmarking savings for marriage, you don’t have to dip into retirement funds, business capital, or emergency reserves.

- Debt-Free Weddings – Avoids the need for personal loans or credit card debt, which many families often fall into during marriage preparations.

- Peace of Mind – Knowing that funds are already set aside allows you to enjoy the occasion wholeheartedly.