Investing for Retirement

Retirement Saving

Retirement planning is essential for maintaining the same standard of living even when your active income stops. Your retirement corpus should be large enough to generate a regular income stream that keeps pace with inflation and matches your current lifestyle. By investing in Mutual Funds now through SIP or Lump sum, you prepare for a retirement where you don’t have to compromise on living standards or depend on others — instead, you enjoy financial independence and peace of mind.

People make the mistake of starting their Investment in Mutual Funds when retirement comes near. One should start investing as soon as one starts earning.

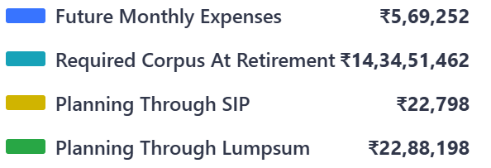

Current Age 25 years, Say Retirement Age 60 years, Say Life Expectancy 80 years, Current Monthly Expenses 1L, Say Inflation Rate 5%, Say Pre Retirement Expected Rate of Return 12%, Say Post Retirement Expected Rate of Return 5%

Age at the time of Investment 25 Years

If an individual begins investing in Mutual Funds right from the time they start earning, say at age 25, and continues till retirement at 60, they can build a substantial retirement corpus with relatively small SIP contributions and modest lump sum investments. However, if they delay and start investing only at 50, they would need to invest a significantly larger amount to achieve the same corpus and maintain their standard of living post-retirement. Hence, it is advisable to start retirement planning through mutual funds as early as possible—ideally from the moment one begins earning.

Benefits of Retirement Savings through Mutual Fund Investments

- Financial Independence Post-Retirement – Helps you maintain your lifestyle without depending on children or others.

- Maintaining Standard of Living – A well-planned retirement corpus ensures you don’t compromise on lifestyle.

- Stress-Free Retirement – Knowing you have a ready corpus gives peace of mind during your golden years.

- Regular Income Flow – With SWP (Systematic Withdrawal Plan), you can create a monthly income stream after retirement.

- Flexibility in Goals – You can plan for healthcare, travel, or other personal goals during retirement.

- Avoiding Last-Minute Burden – Early investments mean you don’t need to put huge amounts later in life.

- Longer Investment Horizon – Starting early allows 30–35 years of compounding, making wealth creation easier.

- Beating Inflation – Long-term MF investments ensure your retirement money grows faster than rising living costs.