Child's Education

Saving for Child’s Education – The Best Time to Start Your SIP is Today.

Planning for your child’s education is one of the most important responsibilities for parents. Quality education today comes at a high cost, and with inflation, it will be even more expensive 15–20 years down the line. For example, the cost of pursuing medicine in India or an MBA degree has already risen sharply over the years. Imagine what it will cost in the future. Without proper planning, this burden can overwhelm families at the wrong time.

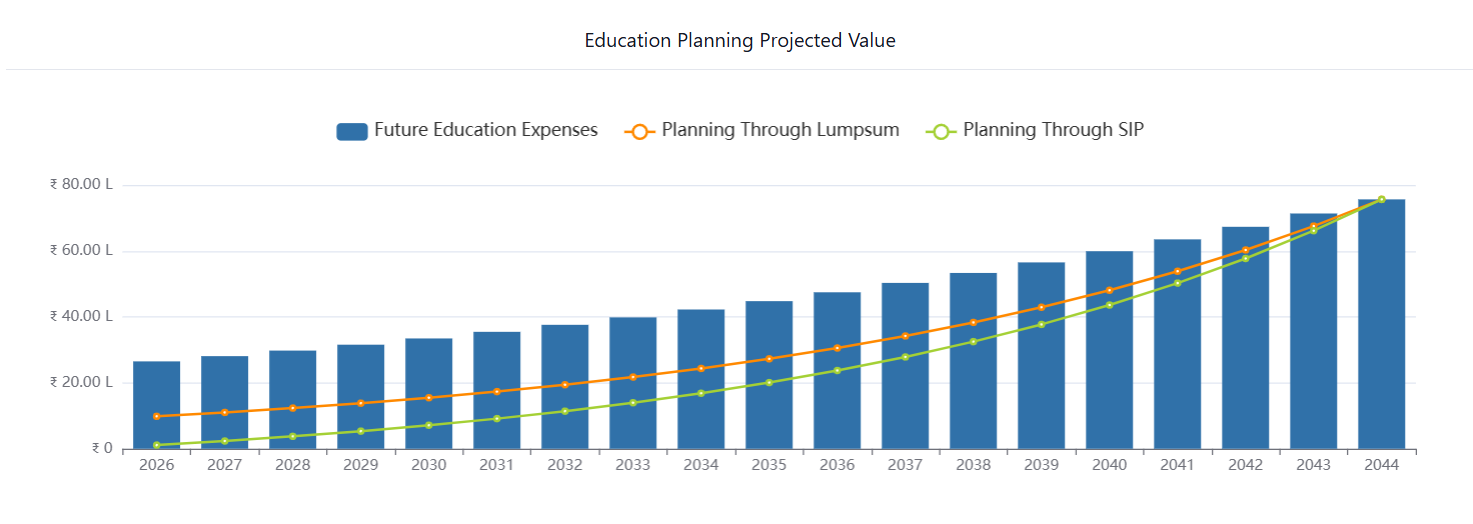

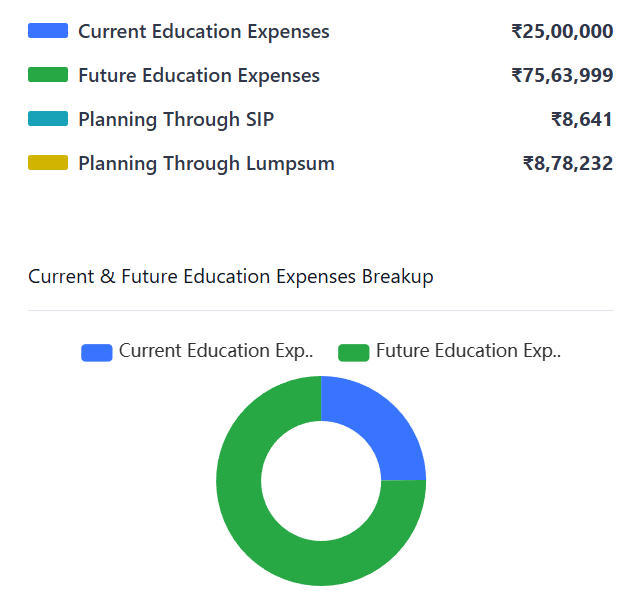

For instance, if higher education costs ₹25 lakhs today, at an average inflation rate of 6%, the same education could cost nearly ₹75 lakhs in 18–20 years. To prepare for this, If you start investing when your child is 1 year old, you can reach this goal by:

- Starting a SIP of ₹9,000/month for 20 years (assuming 12% CAGR), or

- Making a one-time lump sum investment of ₹9,00,000 today.

Education Planning Summary

By investing today, you build a strong education corpus that ensures your child never has to compromise on opportunities and can secure admission into top universities with confidence. One should start investing for a child's education as soon as they are born, so that by the time they are 20, a substantial corpus is already in place to pursue higher education.

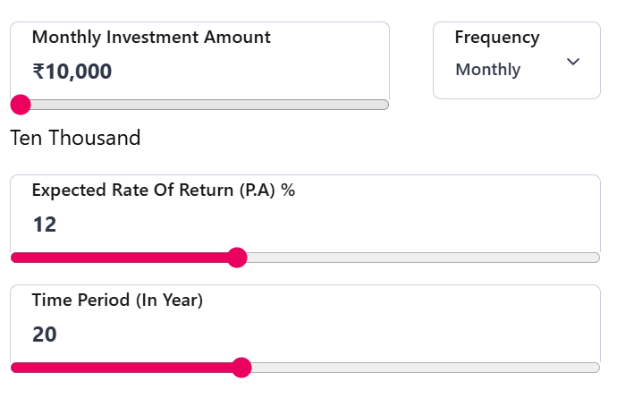

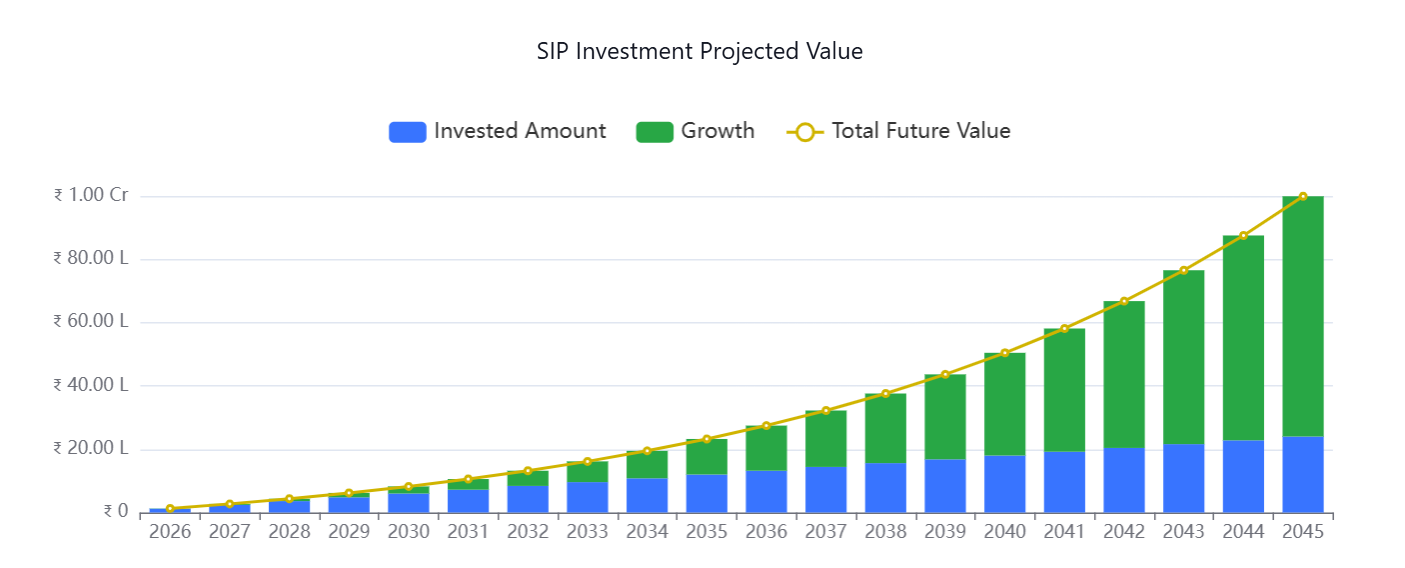

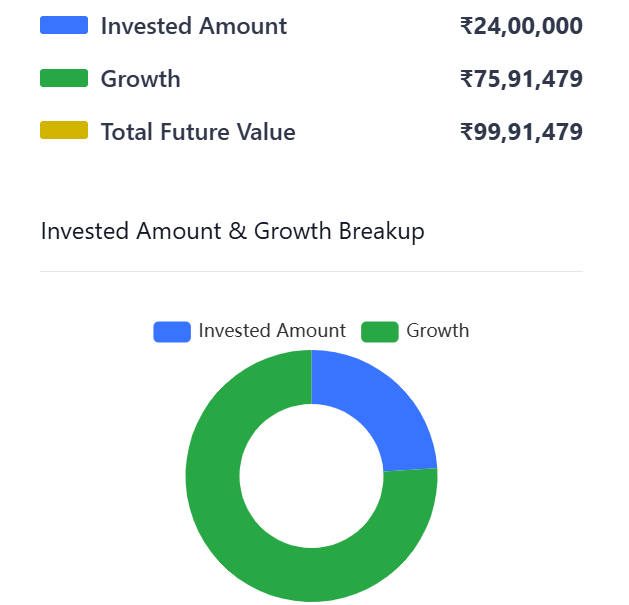

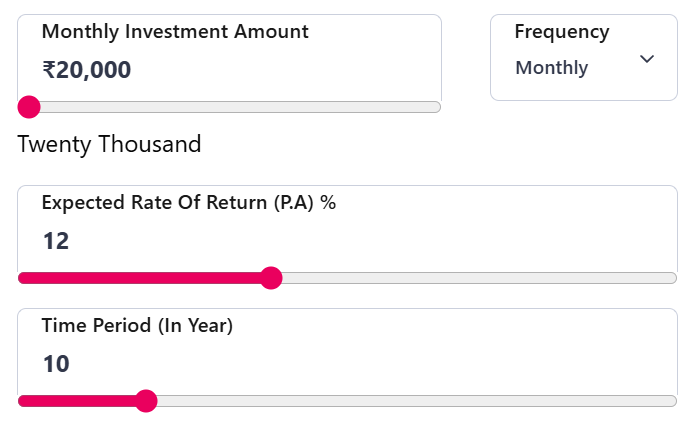

Scenario 1 - A monthly SIP of ₹10,000 invested for 20 years @12% CAGR,

Total Amount Invested ₹24,00,000, Future Projected Value ₹99,91,479

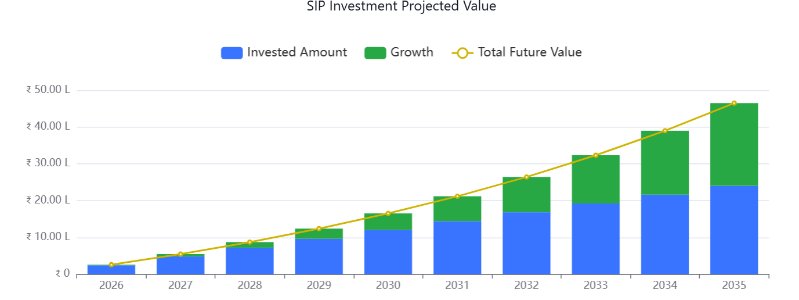

Scenario 2 - A monthly SIP of ₹20,000 invested for 10 years @12% CAGR,

Total Amount Invested = ₹24,00,000, Future Projected Value ₹46,46,782

Benefits of Saving for Child’s Education

- Peace of Mind – No Risk and Burden of hampering the Child’s Education. Parents stay confident knowing their child’s future is financially secure.

- Beats Inflation – Education costs are rising at 8–10% per year. Early investment ensures your money grows faster than inflation.

- Less Financial Burden – Instead of arranging a lump sum at the last moment, you build the corpus gradually and stress-free.

- Power of Compounding – The earlier you start, the more your money multiplies over 15–20 years. Even small SIPs can grow into a large corpus.

- Flexibility of Choice – With funds ready, your child can choose top colleges in India or abroad without financial restrictions.

- No Loans, No Debt – A well-planned education fund reduces or eliminates the need for education loans, saving your child from starting life with EMIs.

- Goal-Based Discipline – Regular investing keeps you aligned with the long-term goal and avoids unnecessary withdrawals.

- Financial Independence for the Child – They can focus fully on studies and career without worrying about financial support.