Child's Future

Child’s Future Savings

As children grow, they may want to start a business, pursue a startup idea, or follow a career path that requires seed capital. Starting Investments in Mutual Funds today for your Children gives them a head start and the financial backing to follow their Business. Early investment in Mutual Funds today save you from worrying later and ensure you don’t have to pull from your retirement savings or working capital when the time comes.

They can start any Business that they desire with confidence. One should start investing for a child's career as soon as they are born, so that by the time they are 25, a substantial corpus is already in place to pursue desired career path.

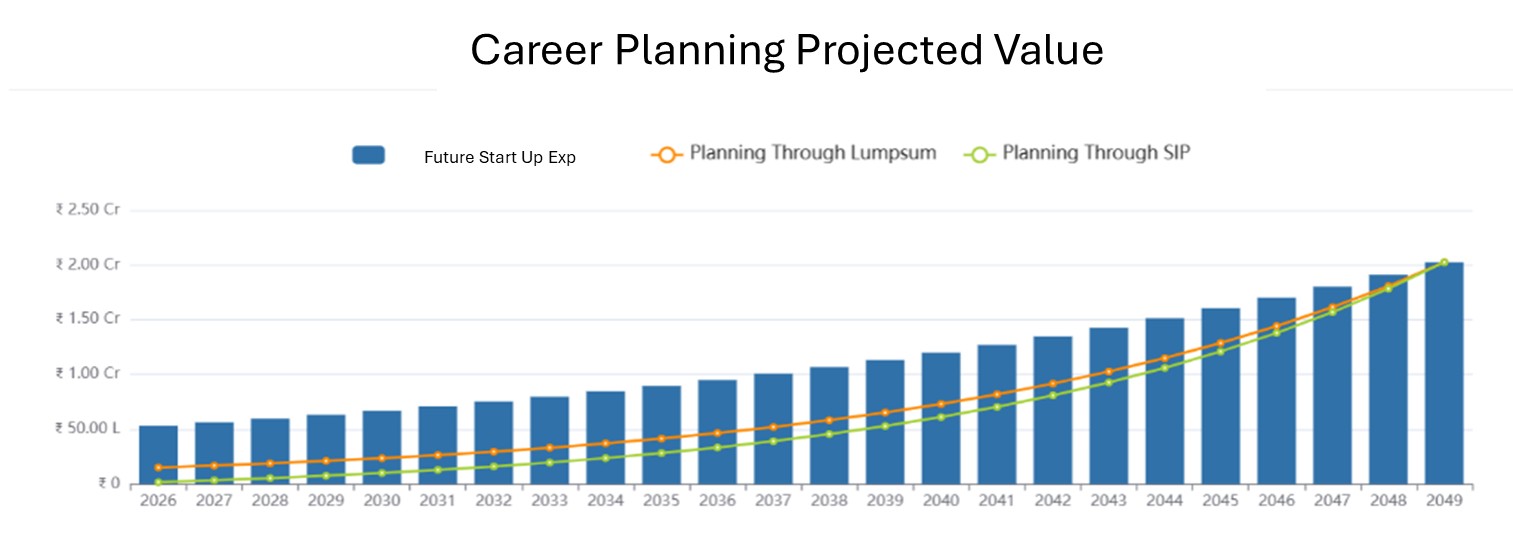

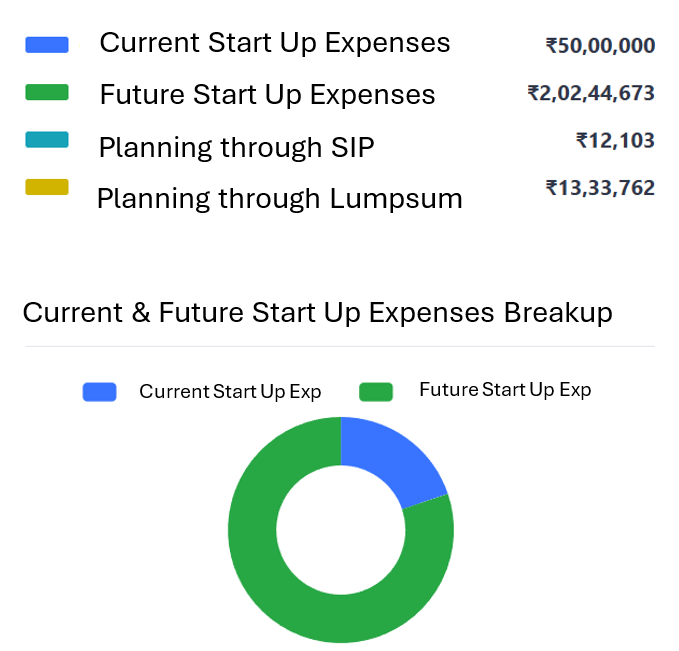

Scenario 1 – Starting Mutual Funds Investment at the age of 1, Say Current Start Up Expenses ₹50,00,000, Age at the time of start of Career 25 Years, Projected Inflation Rate 6%, Projected Rate of Return 12%

To prepare for this, if you start investing in Mutual Funds when your child is 1 year old, you can reach this goal by:

- Starting a SIP of ₹12,000/month for 25 years (assuming 12% CAGR), or

- Making a one-time lump sum investment of ₹13,33,000

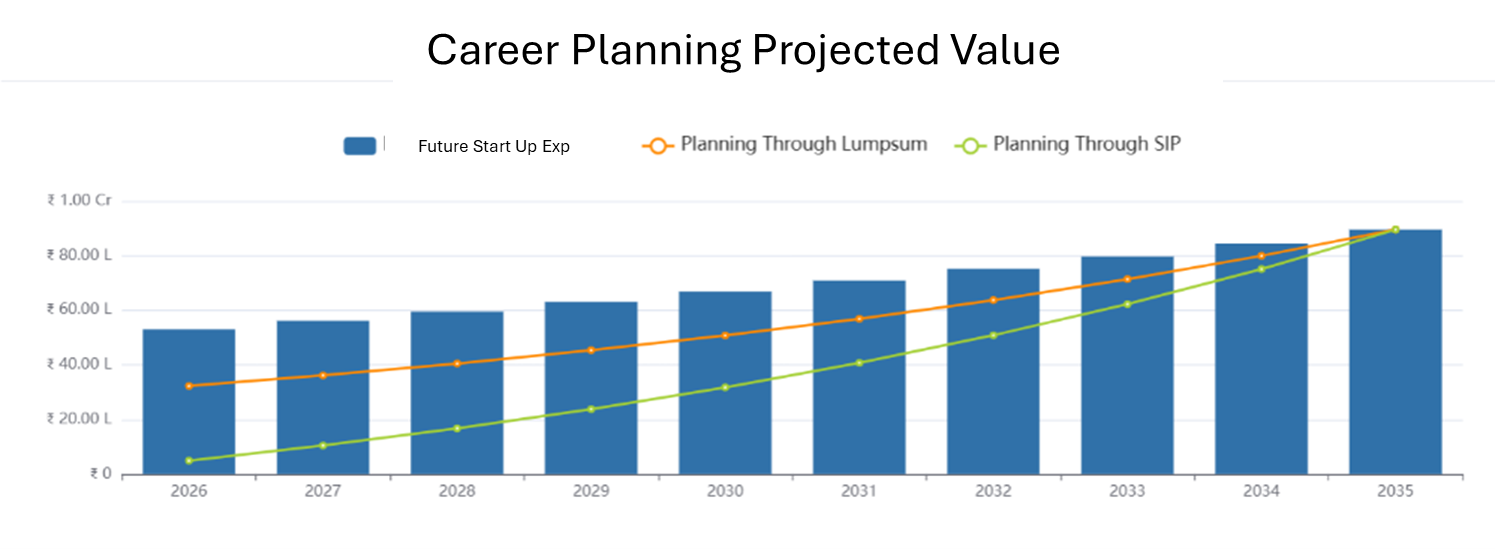

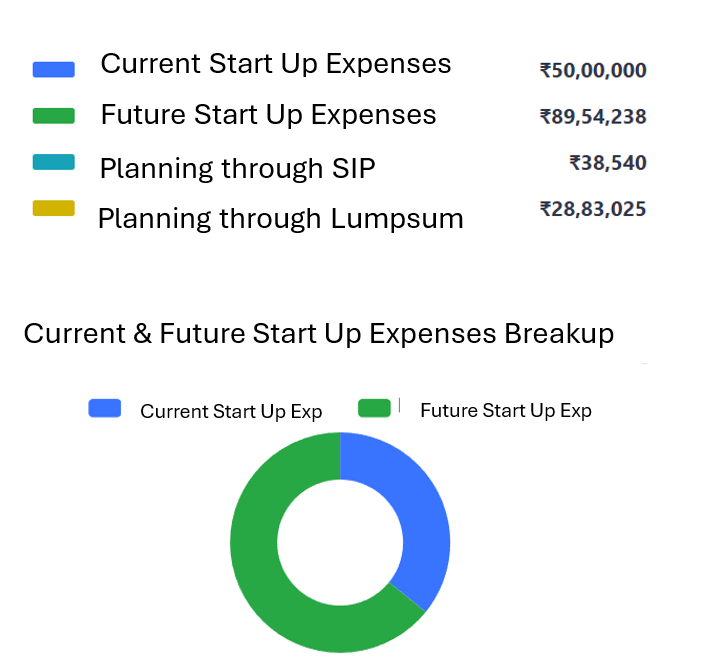

Scenario 2 – Starting Mutual Funds Investment at the age of 10, Say Current Start Up Expenses ₹50,00,000, Age at the time of start of Career 25 Years, Projected Inflation Rate 6%, Projected Rate of Return 12%

To prepare for this, if you start investing in Mutual Funds when your child is 15 years old, you can reach this goal by:

- Starting a SIP of ₹38,500/month for 25 years (assuming 12% CAGR), or

- Making a one-time lump sum investment of ₹28,83,000

MUTUAL FUND SIPs TODAY, FOR YOUR CHILD’S CAREER TOMORROW!

Benefits of Child’s Future Savings

- Early Start Advantage – Investing from birth to 25 allows compounding to build a substantial fund with relatively small monthly contributions.

- Encourages Entrepreneurship – Provides seed capital if your child wishes to launch a startup or business venture.

- Safeguards Your Retirement – Parents don’t need to pull from their retirement savings or working capital when the child needs funds.

- Freedom to Explore Passions – Enables them to pursue unconventional career paths, creative projects, or new opportunities.

- Boosts Confidence & Responsibility – A financial cushion at 25 gives your child the courage to take risks and the maturity to manage money wisely.

- Reduces Need for Loans – With a ready corpus, they won’t have to rely heavily on business loans or borrowings.