Mutual Funds

Mutual Funds

Mutual funds are one of the best investment options for anyone looking to grow wealth in a simple and reliable way. By pooling money from multiple investors, mutual funds create a larger investment corpus that is managed by professional fund managers. These experts invest across a mix of stocks, bonds, and other financial instruments, ensuring diversification and reducing risk. Instead of spending time choosing individual investments, you can rely on mutual funds for professional management and easy access. This makes them a smart choice for both beginners and experienced investors who want to achieve long-term financial goals with confidence.

SIP vs. Lumpsum: What is the Difference and Which is Right for You?

When investing in mutual funds, you can choose between SIP (Systematic Investment Plan) and Lumpsum investment. Both have their advantages, and the right choice depends on your financial situation, goals, and market outlook.

Systematic Investment Plan (SIP)

- How it works: You invest a fixed amount regularly (monthly or quarterly) in Mutual Funds

-

Why it works:

- Creates a saving habit: SIP automatically sets aside a part of your income.

- Builds discipline: Consistent investing avoids emotional decisions and market timing worries.

- Rupee Cost Averaging: Buy more units when markets are down and fewer when they’re up.

- Small Investments become Large: Regular small amounts grow into significant wealth over time.

Best For: Salaried individuals, people with regular monthly income, or anyone who wants to save regularly and grow wealth effortlessly.

Lumpsum Investment

- How it works: You invest a larger amount of money in one go in Mutual Funds

-

Why it works:

- Ideal for extra savings: Perfect when you have surplus funds, like bonuses.

- Market opportunity: Helps you take advantage of market conditions by investing a lump sum amount at once.

- Simple and straightforward: A one-time investment can lead to long-term growth without needing ongoing contributions.

- Efficient wealth growth: A single large investment can help maximize returns, particularly during market dips.

Best For: Suitable for investors with surplus funds who want to grow wealth in a straightforward, efficient manner.

Key Takeaway:

- SIP in Mutual Funds help you save before you spend, makes you disciplined, and builds wealth slowly but steadily.

- Lumpsum Investment in Mutual Funds is ideal when you have a large amount to invest and want your money to start working right away.

- The best part? You don’t have to choose one—you can do both! Many of our clients combine SIPs for regular savings and Lumpsum when it is favourable to invest, depending on the market situation.

LAW OF COMPOUNDING – The 8th Wonder of the World!

The Law of Compounding is the principle where your earnings generate further earnings on earnings over time. In mutual funds, this means your returns get reinvested, and over the years, you earn "returns on returns", creating a snowball effect for wealth growth.

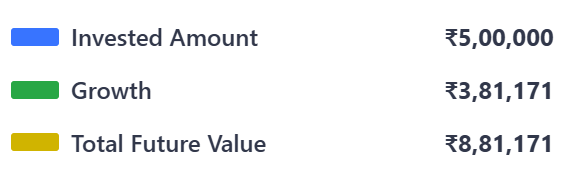

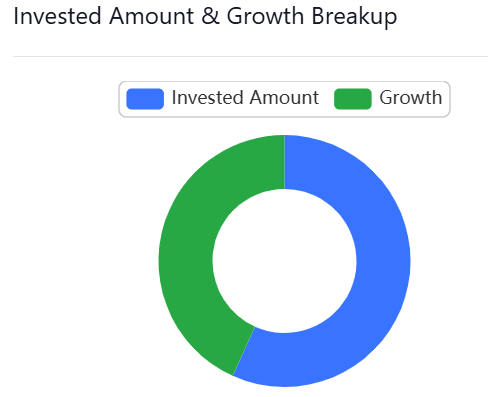

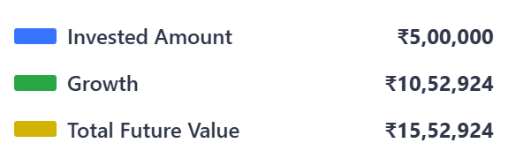

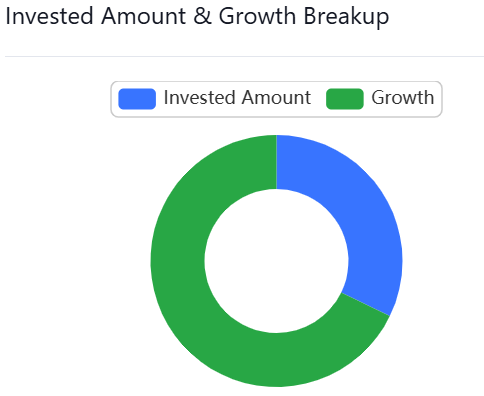

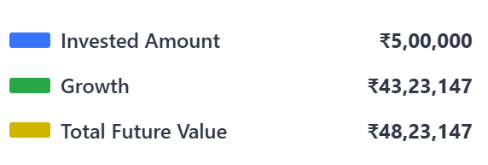

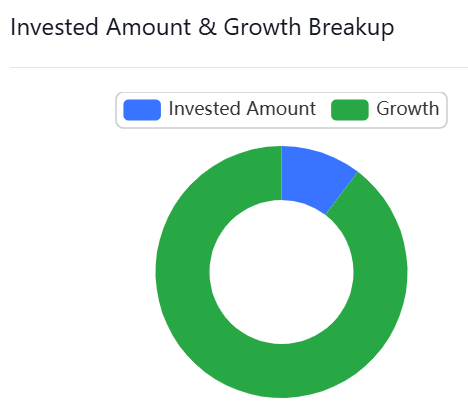

Example: If you invest ₹5,00,000 in a mutual fund with an average return of 12% p.a.

Investment Period 5 Years

Investment Period 10 Years

Investment Period 20 Years

💡 Observation:

- In 5 years, your investment of ₹5,00,000 grows by ₹3.81 lakh to ₹8.81 lakh at 12% CAGR.

- In 10 years, the same amount grows by ₹10.52 lakh, which is much more than twice of ₹3.81 lakh.

- In 20 years, the same amount grows by ₹43.23 lakh, which is 3 times more than 15.25 lakh (i.e. ₹3.81 lakh × 4).

✅ Key Takeaway:

The longer you stay invested, the bigger the compounding effect. Start early, invest regularly, and give your money time to grow.

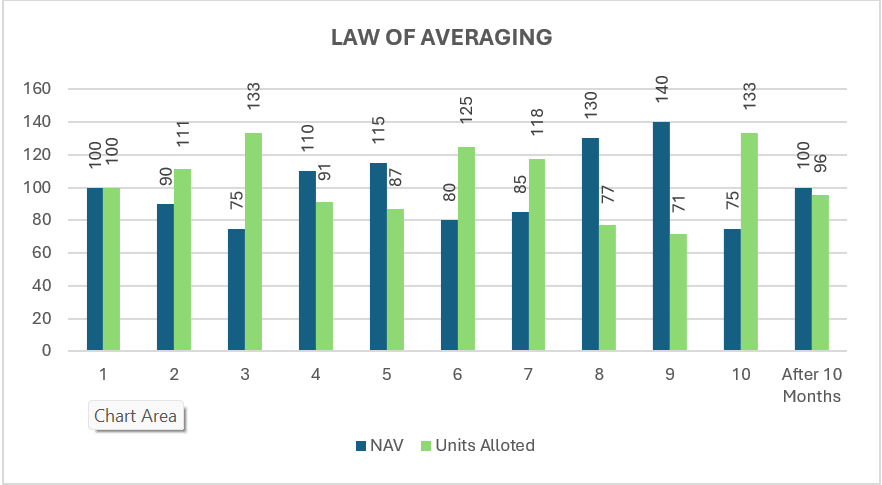

LAW OF AVERAGING -The Best Way to Invest in a Volatile Market!

The Law of Averaging helps investors reduce the impact of market ups and downs. By investing a fixed amount regularly (for example, through a SIP in mutual funds), you automatically:

- Buy more units when prices are low

- Buy fewer units when prices are high

Over time, this averages out your cost per unit, removes the need to time the market, and makes investing more disciplined and stress-free.

Example: You start a SIP of ₹10,000 per month in an equity mutual fund. Here’s how it might look:

| Month | NAV (Price per Unit) | SIP Amount (₹) | Units Bought |

|---|---|---|---|

| Jan | ₹50 | 10,000 | 200.00 units |

| Feb | ₹40 | 10,000 | 250.00 units |

| Mar | ₹60 | 10,000 | 166.67 units |

| Apr | ₹45 | 10,000 | 222.22 units |

| May | ₹55 | 10,000 | 181.82 units |

| Total | 250 | 50,000 | 1,020.71 units |

Average Cost Calculation

- Average purchase price (Law of Averaging) = Total Invested ÷ Total Units = ₹50,000 ÷ 1,020.71 ≈ ₹48.99 per unit

- Suppose, Current NAV = ₹50

- Value of investment = 1,020.71 × ₹50 ≈ ₹51,035

🔹 Key Insight

Even though NAV went up and down (₹50 → ₹40 → ₹60 → ₹45 → ₹55),

your average cost became ₹48.99 (₹50,000 ÷ 1,020.71 units),

which is lower than the simple average of NAV (₹50).

Hence, even if your Current NAV is 49, you are at a profit.

This is the power of the Law of Averaging — you benefit when markets are volatile because your SIP ensures disciplined buying at all levels.

✅ In short:

SIP + Volatility = Averaging works in your favor

Lumpsum Investment

- You invest a large amount in one go.

- Suitable for investors with surplus funds who want their money to start compounding immediately.

- Example: ₹1,00,000 invested at once.

SIP (Systematic Investment Plan)

- You invest a fixed amount regularly (monthly/quarterly).

- Helps you build wealth gradually and consistently.

- Example: ₹5,000 every month.

STP (Systematic Transfer Plan)

- Example: ₹5,000 every month.

- Often used to move funds from a debt fund (safe) to an equity fund (growth) gradually.

- Helps reduce risk of investing a lumpsum in volatile markets.

SWP (Systematic Withdrawal Plan)

- Lets you withdraw an amount regularly from your investment.

- Ideal for generating regular income, especially during retirement.

- Example: Withdrawing ₹10,000 every month from your mutual fund.

Taxation on Capital Gains

-

Tax on Capital Gains on Equity Mutual Funds

-

If you sell your Mutual Fund units within 1 year from the date of purchase:

- The Capital Gains are taxed as short-term at 20%.

- No exemption (entire gain is taxed).

-

If you sell your Mutual Fund units after 1 year from the date of purchase:

- First ₹1.25 lakh Capital Gains in a year are exempt from tax.

- Any Capital Gains above ₹1.25 lakh are taxed at 12.5%.

-

If you sell your Mutual Fund units within 1 year from the date of purchase:

- Capital Gains on Debt Mutual Funds are taxed at Income Tax Slab rates applicable to you.

Point to Note:

- It is advisable to book Long-term Capital Gains of up to ₹1.25L every year on Equity Mutual Funds, to take benefit of income tax exemption on this amount.

- Investment in Arbitrage Funds is treated as Equity Mutual Funds for the purpose of Income Tax rates.

- Tax on the Dividends earned on Mutual Funds are also taxed as per Income Tax Slab Rates applicable to you.

- Tax applies only when you sell your mutual fund.

Why Invest in Mutual Funds

- Professional Management – Expert fund managers research, analyze, and choose the right investments for you.

- Diversification – Money is spread across companies, sectors, and assets, reducing market risk.

- Affordability – Start small with SIPs, no need for large capital to begin.

- Flexibility & Liquidity – Invest or redeem anytime with multiple options for every financial goal.

- Transparency & Regulation – SEBI-regulated with regular performance updates for complete transparency.

- Goal-Oriented – From wealth creation to tax-saving or retirement, there’s a fund for every goal.

- Ease of Investing – Simple online process, SIP or lumpsum options, and 24x7 access through digital platforms.

Types of Mutual Fund Schemes

- Debt Funds – Invest in government and corporate bonds of various durations, ranging from as short as 1 day to over 30 years. Debt Funds can be further divided as:

- Overnight & Liquid Funds – 1 day to 30 days

- Money Market & Ultra Short Funds – 3 to 9 months

- Low & Short Duration Funds – 6 months to 3 years

- Medium & Long Duration Funds – Over 3 years

- Equity Funds – Invest in company shares across large-cap, mid-cap, small-cap, flexi-cap, and multi-cap to build long-term growth.

- Hybrid Funds – Combine equity and debt in varying proportions to offer both growth and income.

- Sectoral Funds – Focus on a specific sector like technology, healthcare, or infrastructure to capture industry growth.